Ankit Kumar 2025-07-25

The Banking, Financial Services, and Insurance (BFSI) sector is experiencing a revolutionary transformation powered by artificial intelligence. With AI in fintech projected to reach a staggering market valuation of $9.48 billion by 2032, financial institutions are rapidly adopting intelligent technologies to stay competitive. According to recent industry reports, over 85% of financial institutions are expected to implement some form of AI by 2025, representing a fundamental shift in how financial services are delivered.

The integration of AI in BFSI is no longer optional but essential for institutions aiming to thrive in an increasingly digital landscape. From automating routine processes to delivering hyper-personalized customer experiences, artificial intelligence is redefining every aspect of the financial ecosystem. This comprehensive guide explores the top 10 AI solutions revolutionizing the BFSI industry in 2025, providing insights into how these technologies are driving innovation, efficiency, and growth.

The journey of AI in BFSI Industry has been remarkable, evolving from basic automation tools to sophisticated intelligent systems. In the early 2000s, financial institutions began experimenting with rule-based algorithms for fraud detection and customer service. By 2015, machine learning applications gained traction, enabling more advanced data analysis and predictive capabilities.

Today, in 2025, we're witnessing the maturation of AI in the BFSI sector, with technologies like deep learning, natural language processing, and generative AI becoming mainstream across the sector. According to Accenture's Banking Trends Report, AI integration is now a standard feature in nearly every banking solution, with providers developing highly advanced, AI-driven products and experiences.

This evolution has been driven by several factors, including:

As a result, financial institutions that have embraced AI in BFSI Industry are seeing significant competitive advantages, with AI-powered banks reporting up to 30% higher customer satisfaction rates and 25% lower operational costs compared to their traditional counterparts.

One of the most transformative AI use cases in financial services is the creation of hyper-personalized banking experiences. Unlike the impersonal digital banking of the past decade, AI is now enabling financial institutions to restore the human touch through intelligent personalization.

Modern AI systems analyze vast amounts of customer data—transaction history, browsing behavior, life events, and even social media activity—to create detailed customer profiles. These profiles enable banks to offer tailored product recommendations, personalized financial advice, and customized user interfaces that adapt to individual preferences.

For example, JP Morgan Chase has implemented an AI system that analyzes over 400 factors to create personalized financial journeys for each customer. This approach has resulted in a 35% increase in customer engagement and a 28% boost in product adoption rates.

By leveraging AI in fintech for personalization, banks are not only improving customer satisfaction but also driving revenue growth through more effective cross-selling and upselling opportunities.

Fraud detection remains one of the most critical AI use cases in finance, with financial institutions facing increasingly sophisticated threats. AI-powered fraud detection systems have evolved significantly, now capable of analyzing transactions in real-time and identifying suspicious patterns that would be impossible for human analysts to detect.

These systems employ a combination of supervised and unsupervised machine learning algorithms to:

According to a 2025 report by Deloitte, financial institutions implementing advanced AI fraud detection systems have reduced fraud losses by up to 60% while decreasing false positives by 50%, significantly improving both security and customer experience.

The integration of behavioral biometrics—analyzing how users interact with their devices—has further enhanced fraud prevention capabilities, making AI in the BFSI sector an indispensable tool in the fight against financial crime.

Risk assessment and management have been transformed by AI in BFSI, with institutions now able to process vast amounts of structured and unstructured data to make more accurate risk decisions. Traditional credit scoring models are being replaced by sophisticated AI algorithms that consider thousands of variables to assess creditworthiness.

These AI-powered risk assessment tools offer several advantages:

Goldman Sachs' AI-driven risk management platform analyzes market trends, economic indicators, and company-specific data to predict potential risks and opportunities with remarkable accuracy. This has enabled the firm to optimize its investment strategies and reduce exposure to market volatility.

For insurance companies, AI use cases in financial services extend to underwriting and claims processing, where AI algorithms assess risk factors and detect fraudulent claims with greater precision than traditional methods.

Conversational AI has evolved dramatically, with virtual assistants now capable of handling complex financial inquiries and transactions. These AI-powered assistants leverage natural language processing and machine learning to understand customer intent and provide relevant responses.

The best AI software in this category goes beyond simple chatbots, offering sophisticated capabilities such as:

Bank of America's virtual assistant, Erica, now handles over 15 million customer interactions monthly, resolving 85% of queries without human intervention. This has reduced call center volume by 30% while improving customer satisfaction scores.

For financial institutions, conversational AI represents a significant opportunity to reduce operational costs while providing 24/7 customer support. According to Gartner, by 2025, financial institutions implementing conversational AI will save an average of $0.70 per customer interaction, translating to millions in annual savings for large banks.

Document processing and Know Your Customer (KYC) procedures have traditionally been labor-intensive and time-consuming. However, AI in fintech has revolutionized these processes through intelligent document extraction and verification technologies.

AI-powered document processing systems can:

HSBC's implementation of AI-driven KYC has reduced onboarding time from days to minutes while improving accuracy rates to over 95%. This not only enhances customer experience but also ensures compliance with increasingly stringent regulatory requirements.

The combination of optical character recognition (OCR), computer vision, and natural language processing makes AI in BFSI Industry particularly effective for automating document-heavy processes, reducing manual errors, and accelerating service delivery.

Algorithmic trading has been transformed by advances in AI use cases in finance, with sophisticated machine learning models now capable of analyzing market data in real-time and executing trades at optimal moments. These AI-powered trading systems can process vast amounts of structured and unstructured data, including news articles, social media sentiment, and economic indicators, to inform trading decisions.

Beyond traditional algorithmic trading, AI is revolutionizing investment management through:

BlackRock's AI-powered investment platform, Aladdin, processes over 200 million calculations per week to optimize investment strategies for trillions of dollars in assets. This level of analysis would be impossible for human managers alone, demonstrating the transformative potential of AI in BFSI.

For retail investors, robo-advisors powered by AI algorithms are democratizing access to sophisticated investment strategies previously available only to high-net-worth individuals.

Open banking initiatives have gained significant momentum, with AI in fintech playing a crucial role in enabling secure data sharing and integration between financial institutions and third-party providers. AI-powered API management platforms facilitate this ecosystem by:

According to a 2025 report by McKinsey, financial institutions embracing AI-powered open banking ecosystems have seen a 40% increase in new customer acquisition and a 25% boost in revenue from third-party partnerships.

While still in its early stages, quantum computing represents one of the most promising frontier technologies for AI use cases in financial services. By leveraging quantum mechanics principles, these systems can solve complex financial calculations exponentially faster than classical computers.

Potential applications of quantum computing in BFSI include:

JPMorgan Chase and Goldman Sachs have established dedicated quantum computing research teams, recognizing the transformative potential of this technology for financial modeling and risk assessment.

As quantum computing becomes more accessible, it will enable AI in BFSI Industry to tackle previously unsolvable problems, creating new opportunities for innovation and competitive advantage.

Generative AI has emerged as a game-changer for content creation and product development in the BFSI sector. These systems can analyze vast amounts of financial data and customer information to generate personalized content, design innovative financial products, and create tailored marketing campaigns.

Applications of generative AI in BFSI include:

Morgan Stanley's implementation of generative AI for wealth management has enabled the creation of highly personalized investment reports that adapt to each client's financial knowledge level and preferences, significantly enhancing client engagement and satisfaction.

The integration of generative AI with other AI use cases in finance is creating powerful synergies, enabling financial institutions to deliver unprecedented levels of personalization and innovation.

Regulatory compliance remains one of the most challenging aspects of the BFSI sector, with institutions facing an ever-increasing volume and complexity of regulations. AI-powered RegTech solutions are transforming compliance from a cost center to a strategic advantage by:

The best ai software for regulatory compliance combines natural language processing to interpret regulatory texts with machine learning algorithms that can identify patterns indicative of non-compliance.

According to a 2025 study by Thomson Reuters, financial institutions implementing AI-powered RegTech solutions have reduced compliance costs by up to 40% while improving accuracy and reducing regulatory risks.

Despite the transformative potential of AI in fintech, implementation challenges remain. Financial institutions must navigate several key obstacles:

As AI systems require vast amounts of data, ensuring privacy and security is paramount. Financial institutions are implementing:

Many financial institutions operate on legacy infrastructure that wasn't designed for AI integration. Solutions include:

The demand for AI talent far exceeds supply, creating a significant challenge for BFSI institutions. Forward-thinking organizations are:

AI systems can perpetuate or amplify biases present in training data. To address this, financial institutions are:

Looking beyond 2025, several emerging trends will shape the future of AI use cases in finance:

Financial services will become increasingly embedded in daily life, with AI systems anticipating needs and providing services proactively without explicit user interaction.

The convergence of quantum computing and AI will enable previously impossible financial modeling and risk assessment capabilities, revolutionizing investment strategies and risk management.

AI will play a crucial role in bridging traditional financial services with decentralized finance, enabling secure, compliant integration between these ecosystems.

Advanced systems will recognize and respond to customers' emotional states, enabling more empathetic and effective financial guidance and support.

The integration of AI in BFSI is transforming the industry at an unprecedented pace, creating new opportunities for innovation, efficiency, and customer engagement. The top 10 AI solutions highlighted in this article represent the cutting edge of AI use cases in financial services in 2025, but they are merely the beginning of a more profound transformation.

Financial institutions that successfully implement these AI solutions will not only survive but thrive in an increasingly competitive landscape. Those that fail to adapt risk being left behind as customer expectations and competitive pressures continue to evolve.

As we look to the future, the most successful BFSI organizations will be those that view AI not merely as a technology but as a fundamental business strategy that transforms every aspect of their operations. By embracing the full potential of AI in fintech, these institutions will shape the future of finance for decades to come.

For businesses looking to navigate this evolving landscape and harness the power of AI for their financial services, partnering with experts who understand both the technology and the intricacies of the BFSI sector is crucial. Companies like Es Magico are at the forefront of delivering cutting-edge AI solutions tailored to the unique needs of the financial industry, helping institutions unlock new efficiencies, enhance customer experiences, and ensure robust security in the age of intelligent finance.

Read More: 10 Best AI Tools for Small and Medium Businesses

Share On:

Discover how AI is transforming the retail industry with 10 powerful use cases—from personalized shopping to intelligent inventory and dynamic pricing. Learn how businesses can harness AI for efficiency, customer engagement, and growth.

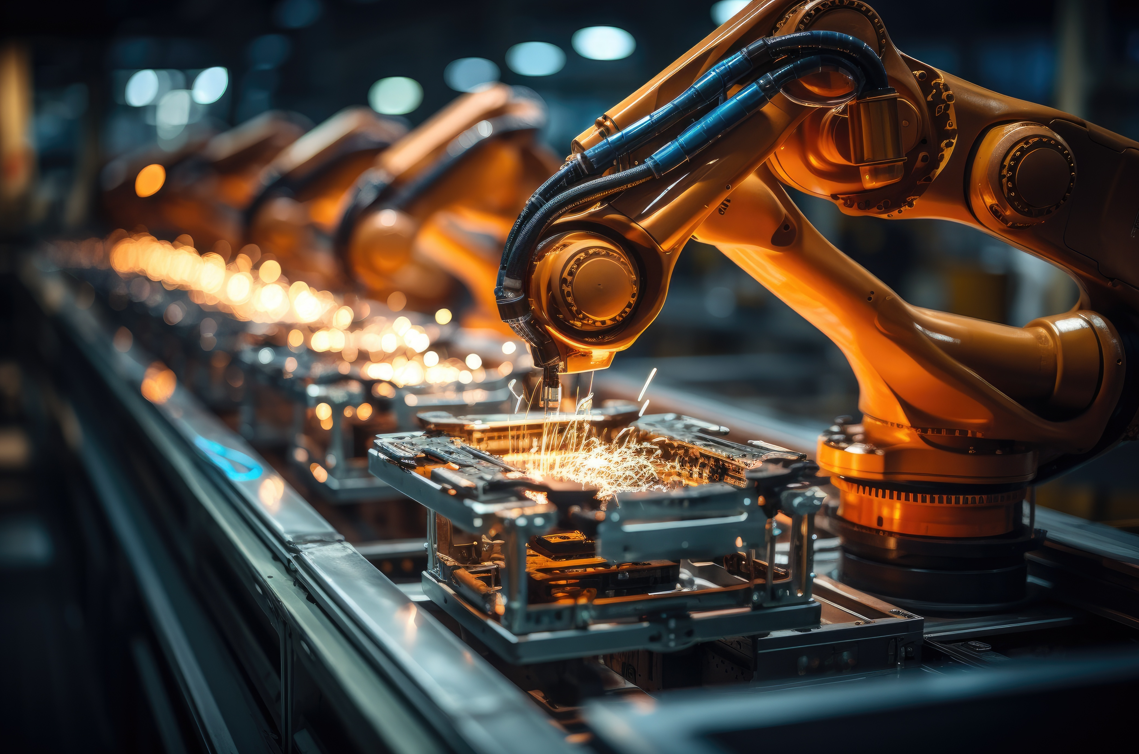

Discover how AI in manufacturing is revolutionizing quality control, predictive maintenance, and efficiency, driving Industry 4.0 growth.

How AI is transforming smart manufacturing and industrial automation. Learn real-world benefits, use cases, and how Es Magico empowers businesses with AI solutions for the future of industry.